Souqalmal.com has registered a rise in the number of UAE residents searching for and wanting to know more about home loans available in the market. There has been an increase of 36 percent in the number of visits on the website’s home loan pages this year, compared to 2014.

There are over 70 home loans listed on Souqalmal.com. Out of these, 33 are conventional mortgages and 37 are Shariah-compliant home finance products. We analyzed our home loan database to know more about mortgage products in the UAE, and statistics and trends that would affect you as a potential borrower.

Eligibility criteria for home loans in the UAE

If you’re earning a monthly salary of AED 20,000 in the UAE, you will meet the minimum salary requirement for 84 percent of home loans available in the market. According to our analysis, 57 percent of UAE home loans are available to those earning between AED 10,000-20,000 and 27 percent for those earning AED 10,000 or lower per month (though minimum salary requirements for home loans start at AED 7,000-8,000).

Besides minimum salary requirement, your eligibility for a home loan will also depend on a number of other factors such as if you work for a listed company, minimum length of service etc. Banks offering home loans to self-employed individuals will have a separate set of criteria like minimum length of business, business turnover etc.

Majority of home loans in the UAE (84 percent) don’t have a salary transfer requirement i.e. you don’t have to transfer your salary in order to be eligible to apply for a mortgage with the bank. However 89 percent of all home loans are only offered to those applicants who are working for companies that are on the banks’ approved employers list.

Interest/profit rates and other fees associated with home loans

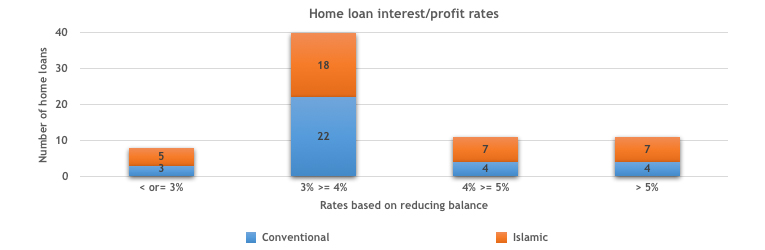

As per our research, 57 percent of all home loans are offered at reducing interest/profit rates ranging from 3 percent to 4 percent. Only about 11 percent of the home loans are offered at rates lower than that, with the lowest rates starting from 2.94-2.95 percent, based on reducing balance. You can also calculate your mortgage repayments in a few simple steps with our mortgage calculator.

Besides the interest cost, there are various other fees and charges associated with home loans. Here are some of the most important ones that you need to know about:

- Arrangement fee: This is the one time processing or set-up fee which usually is about 1 percent of the loan amount.

- Valuation fee: This fee is charged for valuation of the property and could range from AED 2,500-3,000 at most banks.

- Property insurance/Takaful: This could range between 0.03-0.06 percent of property value.

- Life insurance/Takaful: This fee starts from 0.35 percent at most banks in the UAE. Many banks can also assign your personal life insurance policy to the mortgage, upon request.

- Early settlement fee: This fee is 1 percent of the outstanding loan amount, subject to a maximum of AED 10,000 as per UAE Central Bank regulations.

Know the home loan variants available in the market

Nearly two-thirds of all home loans (64 percent) are also available for those looking to purchase an under-construction or off-plan property. But most banks will have a list of approved projects or developers for such loans.

Potential borrowers also have the option to choose from fixed and variable rates on home loans. If you take a loan with a variable rate, the rate will vary with the market and your overall loan repayment may go up or down depending on how the rate changes. Under the fixed rate option, the rate is usually fixed for one year up to a maximum of five years at most banks. Thereafter, the rate is variable. Our analysis shows that 56 percent of home loans in the UAE offer a fixed rate option.

If you’re looking for a mortgage, do your research and compare all your options before signing on the dotted line. You can filter results based on a number of criteria from over 70 home loans on Souqalmal.com to find the one that suits your requirements.

[Related: 80% of personal loans are for salaries of AED 10,000 or lower]