According to the Central Bank’s latest Credit Sentiment Survey (Q3 2015) the UAE credit market has witnessed a growth in demand for personal loans among residents. Lenders attribute the change in demand for loans was attributed primarily to the outlook for the financial and housing market, as well as changes in income across the UAE. There was also a moderate easing of credit standards observed in personal lending, among other loan categories.

Navigating personal loans in the UAE can be a tricky affair if you aren’t aware of the key features of this lending market.

There are a total of 91 personal loans listed on Souqalmal.com, out of which 41 are conventional and 50 are Shariah-compliant Islamic loans. We analyzed our personal loan database to know about the characteristics of the lending market, statistics and trends that would affect you as a potential borrower.

How do banks decide if you’re eligible or not?

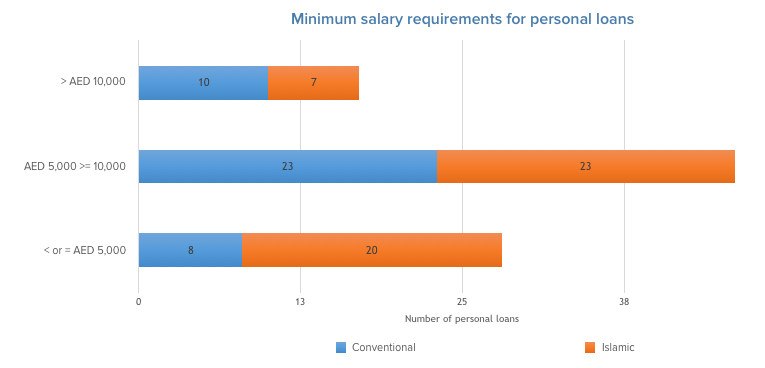

Majority of the loans (almost 82 percent) are offered to those with a minimum monthly salary of AED 10,000. Of these, 51 percent are offered to those earning at least AED 5,000-10,000 per month, while 31 percent are available to those earning AED 5,000 or lower. Minimum salary requirements for personal loans start at a minimum of AED 3,000, however rates are most likely to be linked to an individual’s earning capacity. Banks may not offer their lowest advertised rate to someone just meeting the minimum salary criteria.

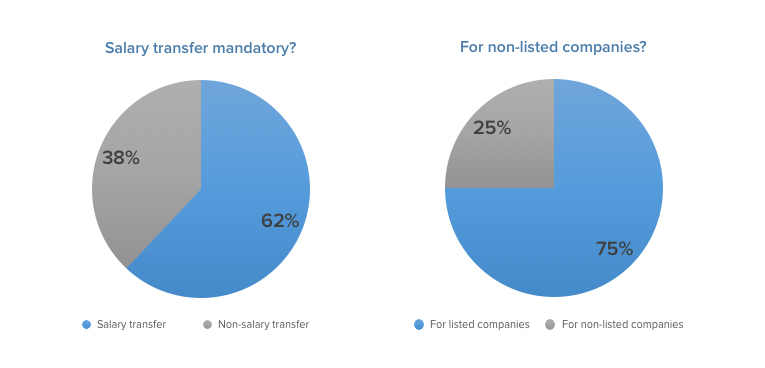

62 percent of all personal loans have a mandatory salary transfer requirement. While the remaining 38 percent are available to those who do not wish to transfer their salary to the lending bank. Average interest/profit rates for non-salary transfer loans hover around 15 percent and can go up to 20 percent or higher. This is because the loan is unsecured and is treated as high risk debt by the bank.

Only 25 percent of personal loans are offered to employees working for non-listed companies, i.e., companies which are not on the bank’s approved list. Banks in the UAE have traditionally used such lists as the sole measure of an individual’s credit worthiness. However, with the introduction of credit reporting, the criteria banks use for lending is set to become more sophisticated.

How much would a personal loan cost you?

An analysis of personal loans listed on Souqalmal.com reveals that most personal loans (48 percent) are offered at rates ranging between 5 percent to 10 percent, based on reducing balance. One must be aware that some banks also advertise flat rates, which are not the same as reducing rates. At Souqalmal.com we allow you to compare all personal loans on a standard platform and provide you with both flat and reducing rate to simplify your search.

Besides the interest/profit, there are other fees and charges that will add to the final cost of the loan. The upfront arrangement or processing fee is usually 1 percent of the loan amount and ranges between a minimum of AED 500 to a maximum of AED 2,500. Besides that, most banks also levy an insurance fee which could be anywhere between 0.5%-1.5% of the loan amount. Potential borrowers must also be aware of the early settlement fee that banks charge if you want to pay off your loan mid-tenure – 1 percent of outstanding amount or AED 10,000 whichever is lower.

If you’re considering applying for a personal loan, you can also use our Personal Loan Calculator to find out how much the loan will actually cost you. This easy-to-use tool can help you calculate your estimated monthly repayments, and also provide you with a list of personal loans that you are eligible to apply for, based on your salary.