Why do we save money? Whether it’s due to fear of unforeseen circumstances or aimed at earning a return on our money or both, we’re constantly on the lookout for a good way to ensure that our savings stay safe, are accessible and can grow with time. And what’s better than a bank account that checks all these boxes?

There are over 300 accounts listed on Souqalmal.com, being offered by 23 different providers in the UAE. We carried out an analysis covering all these products and here’s what you need to know about bank accounts in the UAE.

Looking for an account? What are the options available?

Over half of the accounts listed on Souqalmal.com are Deposit Accounts which are offered for a wide range of flexible tenures and earn you returns in the form of pre-decided interest rates for conventional accounts or profit rates declared per quarter for Islamic variants. 24 percent of all accounts are Savings Accounts which offer you access to your money and at the same time offer an interest/profit payout. However, banks usually levy some form of transaction-related charges on savings accounts.

Current Accounts are the non-interest generating bank accounts which form 20 percent of all accounts listed on the site, and give account holders the easiest access to their funds, thus making them a good choice for daily banking needs for most people. And then there are certain Hybrid or Combination Accounts as well (5 percent of all accounts listed on the site), which bring together the best features of current and savings accounts.

Conventional or Islamic, AED or another currency – Take your pick

38 percent of all accounts offered in the UAE are Shariah-compliant. So if you pick a Shariah compliant savings or deposit account, instead of a fixed interest rate, you would get your returns based on a profit rate which is declared by banks every quarter. At Souqalmal.com, we make your search for the right account easier with regularly updated rates for savings accounts and deposit accounts available in various tenures.

With the UAE’s expat-dominated population, majority of the banks offer accounts in not just AED but various major international currencies, with accounts dominated in GBP, EUR and USD being the most common options available. According to our analysis, 68 percent of all accounts in the UAE are available in multiple currencies.

Browse through over 50 Current Accounts in the UAE.

Is there a minimum balance required? If yes, how much?

Our analysis showed that most banks in the UAE (50 percent) have a minimum balance requirement of AED 3,000 for Current and Savings Accounts. This is the average balance that account holders must maintain in their accounts per month to avoid being charged a penalty fee. 22 percent of all Current and Savings Accounts have no such minimum balance requirement.

On the other hand, minimum balance requirements for Deposit Accounts range from AED 5,000 to AED 10,000 at most banks in the UAE. And you can choose from a range of flexible tenures starting from one week, one to twelve months and usually going up to three to five years.

How much can you earn on your bank account?

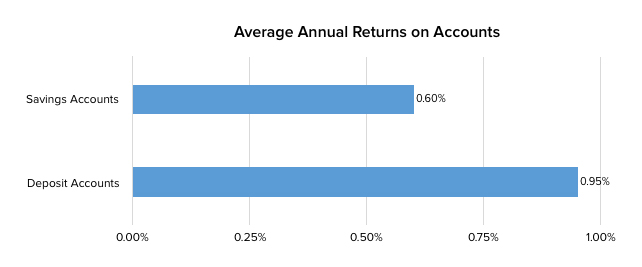

Based on our analysis of returns on accounts in the UAE, the average interest/profit rate on term deposits of varying maturities is just under 1 percent per annum (0.95 percent p.a.). The same for savings accounts is 0.60 percent per annum.

The interest/profit rates in the UAE, however, are lower than various other countries. For example, you could earn up to 2-3 percent on savings accounts and deposits in the UK and a significantly higher 7-8 percent on fixed deposits in India. But given the high-interest regimes, interest rates on loans are also significantly higher in countries like India.

[Related: Emergency fund – Are you prepared for the worst?]

So, is it worth putting your money in a Savings or Deposit Account?

If you have spare cash that you don’t need in the near future or want to put aside some money for emergencies, a Deposit Account is a good choice, since it earns you a return on your money over a fixed period of time. Unlike many other forms of investment, Term Deposits don’t involve any market related risk, thus making them a safe investment. And in case you want the flexibility of accessing your savings at any point of time but still want to earn some returns, a Savings Account would be a good bet for you. Based on your requirements, both options offer you the potential to help grow your savings which would otherwise only take a beating with rising inflation and the overall cost of living.

You can browse through over 60 Savings Accounts and 150 Deposit Accounts in the UAE, and apply for the one that meets your requirements.